For some time, the rules concerning the Value Added Tax (VAT) implementation in the United Arab Emirates (UAE) and further across the Gulf Cooperation Council (GCC) members have been published. We expose here how these updates will impact the business practice in the UAE and what to learn from VAT execution across the world. Regarding the VAT, all concerned parties will get to know each other for the first time. The risk of negatively affecting business is present, but so are the chances of using this new information exchange process to boost competitiveness and trust across the GCC.

Once a tax form is introduced, it is extremely unlikely that it will ever be removed. Across many countries that have levied VAT for several years, temporary taxes that were raised based on an extraordinary circumstance are still being collected. Businesses will have to shift gears and adapt for a new long-term reality. Once the collection infrastructure is in place, governments are unlikely to de-invest this infrastructure and do without a source of income. To cater to this situation, businesses have to have a long-term business strategy in place that allows them to keep a competitive edge.

One might think that exempting small businesses with smaller revenues or supply bills is a good idea, as they probably lack the infrastructure to carry out tax accounting procedures or it might result in an unbearable financial and operational burden. This is nevertheless an incomplete view on how small businesses might actually be able to profit from registering to the VAT regime.

A business model that plans to acquire assets or spend on services for more than a fiscal period will be unable to claim the VAT on their purchases. Later on, they will have paid more than what they were intended to and will not be able to acquire goods and services as cheap as larger companies do.

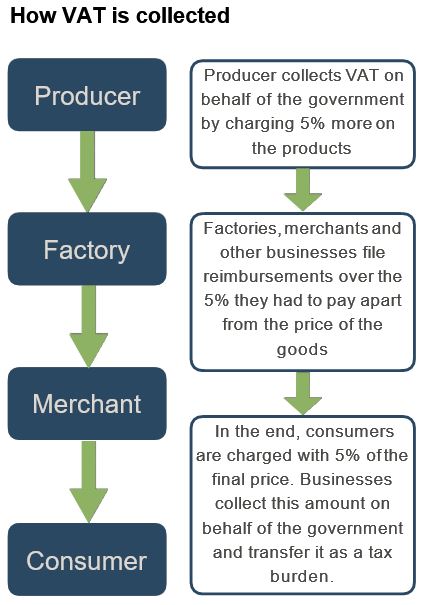

As an indirect tax that is carried by customers and collected by businesses on behalf of the government, it would seem to be the easiest and most practical form of taxation. Yet it can become the most complex form of all when considering exemptions and preferential rates.

Policymakers usually exempt certain activities and entire sectors of the economy believing that this will have an overall positive impact.

From a purely operational perspective, excluding certain sectors from taxation entails two main risks:

Moreover, businesses might face the challenge of claiming a tax return when services are bundled. If, for example, leisure (non-exempt) and healthcare (exempt) activities are bundled as a single service, are they entitled to be exempt as a whole? Practice is much more complex than the law specifies.

The implementation of VAT is a reality, and not all aspects are risks. There are opportunities to gain a competitive edge over other economies and help local businesses contribute their share in transforming Dubai to the trade Hub of the Future:

The classic way for the UAE to catch up with other economies is by outpacing them. As tax claims are predicted to be carried out online, so should the invoice process happen between companies. Having a smart, standard form of invoice would eliminate inefficiencies at an unprecedented scale.

The UAE has dramatically improved its ranking within the World Bank’s Ease of Doing Business Survey to place 26th: and it has a good reason. The cooperation between government and the private sector is unique. So should both sides work towards creating accounts that will make it easy to export. Creating current accounts for companies to prevent large amounts of tax receivables is one step in the right way.

The introduction of VAT will change all aspects of doing business in, through and with UAE based companies. As a growing trading hub, the impact of eventual distortions will have to be recognized by businesses pro-actively. The usage of smart invoicing and agile current accounts can alleviate the impact that VAT will have in a company´s cash flow management and operations.